The veterinary medicine industry includes segments such as veterinary vaccines, veterinary antibiotics and veterinary parasites. Global Veterinary Medicines Market Size will reach approximately US$38 billion in 2019. The market is forecast to expand to $61 billion by 2023, equivalent to a compound annual growth rate (CADR) of approx. 12.5%. The production and consumption of veterinary drugs in Vietnam has also witnessed rapid growth over the years. With 10 years of experience in consulting for the construction of veterinary medicine manufactories, GMPc Vietnam would like to summarize and present an overview of the industry market through the article below.

Overview of Veterinary medicine market

Global veterinary medicine market aced for $22,973 million in 2019 and is expected to reach $29.698 million by 2027, achieving a CAGR of 4.6% 2020 to 2027.

Veterinary medicine is referred to as any product used to treat various medical conditions in animals. Veterinary medicine, for example, includes drugs such as anti-infectives and parasiticides, which are administered orally to animals. Similarly, veterinary medicine also includes vaccines, which are used to build immunity in animals against various infectious diseases such as equine influenza (EIV) and respiratory syncytial 3 parainfluenza. In addition, they also include medicinal feed additives, which are mixed with animal feed to provide medicinal effects on animals. Furthermore, veterinary drugs are used on a wide variety of animals including companion animals such as dogs and cats and livestock animals such as cattle, pigs and poultry.

Some medical conditions in animals treated with veterinary drugs include pain and inflammation associated with osteoarthritis, hookworms, flagellates, infections, and others.

Key factors contributing to the growth of the veterinary medicine market include the increase in the number of pet owners and the increase in the number of pets globally. Furthermore, factors such as the proliferation of various diseases in animals and the increased demand for livestock products also drive the growth of the veterinary medicine market. In addition, increasing animal health care spending is a key factor driving the growth of the market. However, lack of veterinary infrastructure in less developed ries and strict regulations regarding medicinal feed additives have limited the growth of the veterinary medicine market. On the contrary, raising awareness about animal health presents lucrative opportunities for the veterinary medicine market.

Moreover, the COVID-19 pandemic has also adversely affected the market. For example, after COVID-19 was declared a pandemic by WHO, ries worldwide adopted nationwide lockdown measures to observe social distancing as a measure to prevent the spread of the virus. spread. This leads to disruptions, limitations, challenges and changes in every sector of every industry. Similarly, the veterinary medicine industry has also been affected by the pandemic. For example, veterinary organizations across the globe have recommended limiting animal patient care to critically ill and emergency animals. Furthermore, the lockdown has led to the rescheduling of annual physicals and elective procedures. However, various key companies have secured the supply of veterinary drugs as government agencies globally are taking strict measures to maintain the supply.

Veterinary medicine market segment

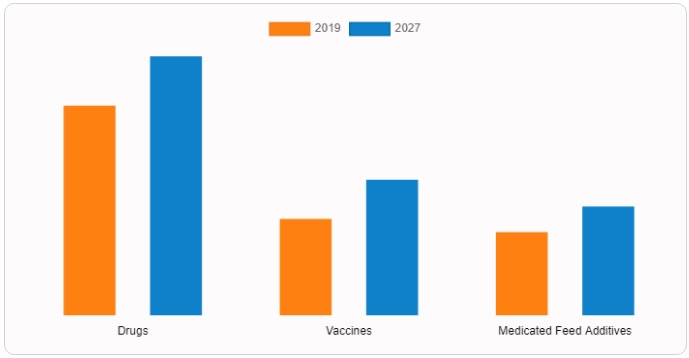

The global veterinary medicine market is segmented based on product, route of usage, livestock type, distribution channel and region to provide a detailed market assessment. By product, it is divided into drug, vaccine and drug feed additive. The drug segment is divided into anti-infective, anti-inflammatory and antiparasitic. In addition, the vaccine segment is divided into inactivated vaccines, attenuated vaccines, and recombinant vaccines. Similarly, the medicated feed additive segment is divided into amino acids and antibiotics.

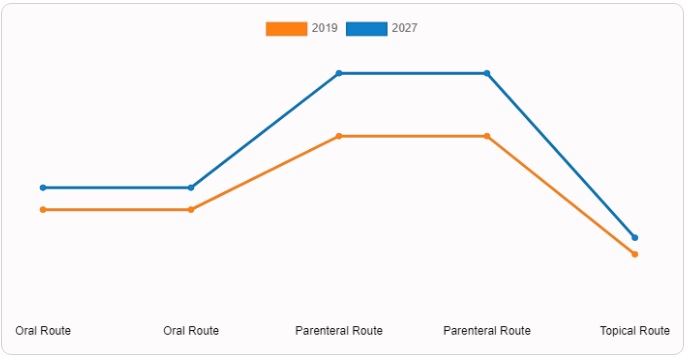

According to usage, the market is divided into oral, injectable and topical. According to the type of animal, it is divided into companion animals and livestock animals. By distribution channel, it is classified into veterinary hospital, veterinary clinic and pharmacy & drug store. By region, the veterinary medicine market size is analyzed across North America (USA, Canada and Mexico), Europe (Germany, France, UK, Italy, Spain and rest of Europe), Europe Asia-Pacific (Japan, China, India, Australia, Korea and rest of Asia-Pacific) and LAMEA (Brazil, Saudi Arabia, South Africa and rest of LAMEA) .

Segments Analysis

Based on the type of products, the drug segment aced for the largest share in 2019, due to factors such as the increase in the prevalence of parasites in animals and the increase in the prevalence of various infections, treated with anti-infectives. Furthermore, other factors contributing to the growth of the market include the increase in awareness regarding the use of drugs in animals and the increase in the use of veterinary drugs globally.

According to the usage, the parenteral segment aced for the largest share of the veterinary drug market in 2019. The growth of this segment was driven by the large number of injectable preparations offered by the host companies. lock in the market. Additionally, the topicals segment experienced the fastest growth as key players increased their focus on launching new topical products for the treatment of parasites.

In 2019, North America aced for a large share of the veterinary drug market size and is expected to continue this trend, due to the skyrocketing number of companion animal owners and the easy availability of veterinary drugs. . In addition, other factors such as a sharp increase in veterinary spending also boosted the growth of the veterinary medicine market in the region. Asia-Pacific is expected to experience the fastest growth, due to rapidly increasing awareness regarding the use of veterinary drugs. Other factors driving the growth of the market include increasing awareness regarding animal health and increasing ownership of companion animals in the region.

The global veterinary medicine market is highly competitive and well-known companies in the market have adopted various strategies to gain maximum market share of veterinary drugs. These include partnerships, product launches, partnerships, and acquisitions. Major players operating in the market include Zoetis, Inc., Merck & Co., Inc. (Intervet International BV), Elanco Animal Health, Dechra Pharmaceuticals PLC, Ceva Santé Animale, Virbac., Vetoquinol SA, Boehringer Ingelheim International GmbH., ADM Animal Nutrition and Evonik Industries AG.

With more than 10 years of experience in the field of consulting for construction of veterinary medicine manufactories, GMPc Vietnam has been chosen by many project investors such as: Can Tho Veterinary Medicine factory (Veterco), Greenviet Veterinary Medicine Factory (Phu Thai), CP Vietnam,...

Esteemed customers who are in need of investment construction a veterinary drug factory, please contact us via hotline: 0982.866. 668

See more:

Veterinary medicines manufactory projects consulted by GMPc

List of consulting services for Veterinary medicine manufactory